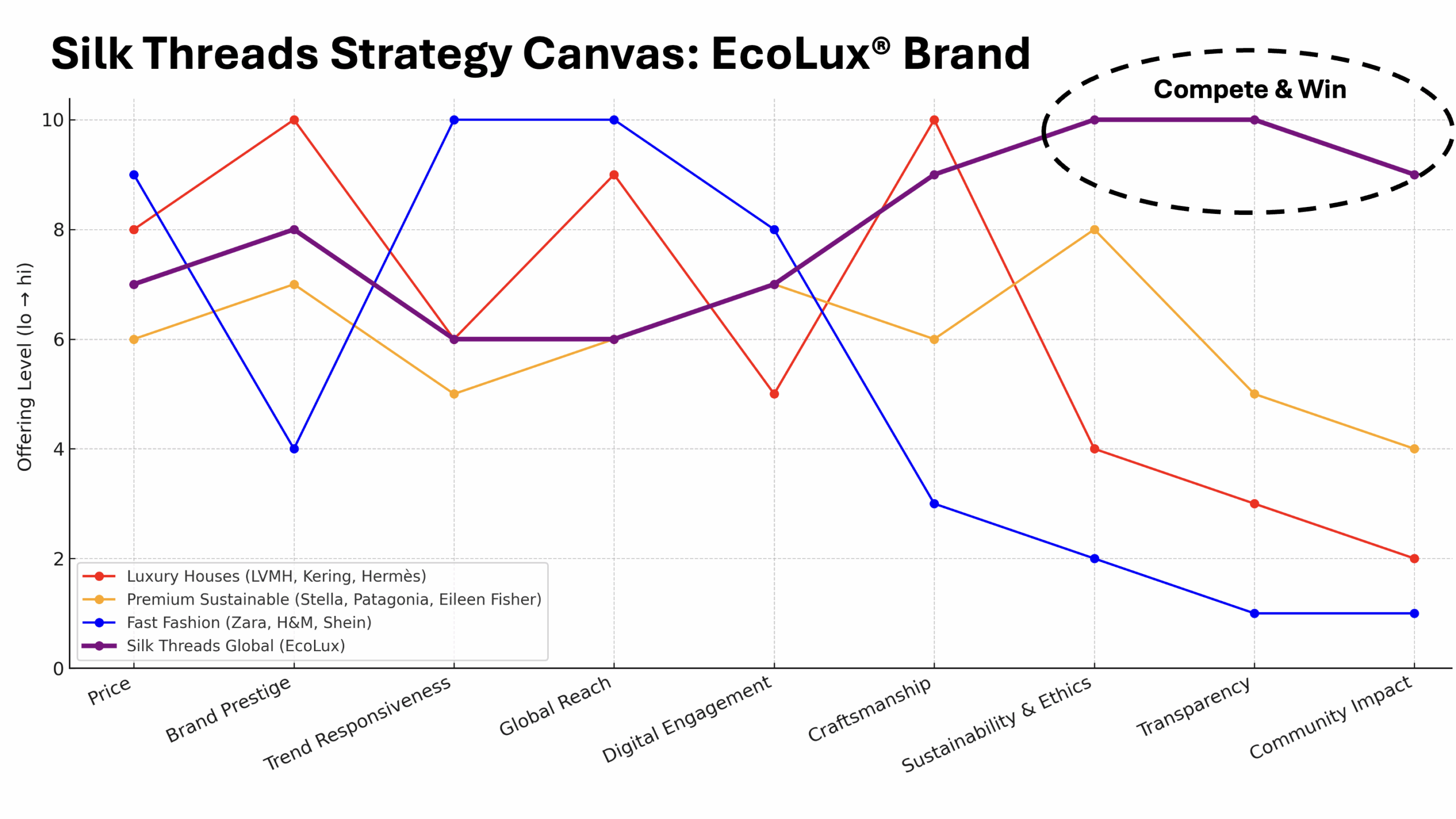

The global fashion industry is intensely competitive, with brands fighting for attention across luxury, premium and

fast-fashion segments. At the luxury end, houses like LVMH, Kering and Hermès set the standard in heritage, pricing power and

global distribution. At the same time, digital-first, sustainability-forward newcomers are pushing the sector to modernise

its storytelling.

In the premium space, labels such as Stella McCartney, Patagonia and Eileen Fisher have built loyal followings by hardwiring

environmental and social responsibility into their brands — showing that ethics can be a selling point, not just a cost.

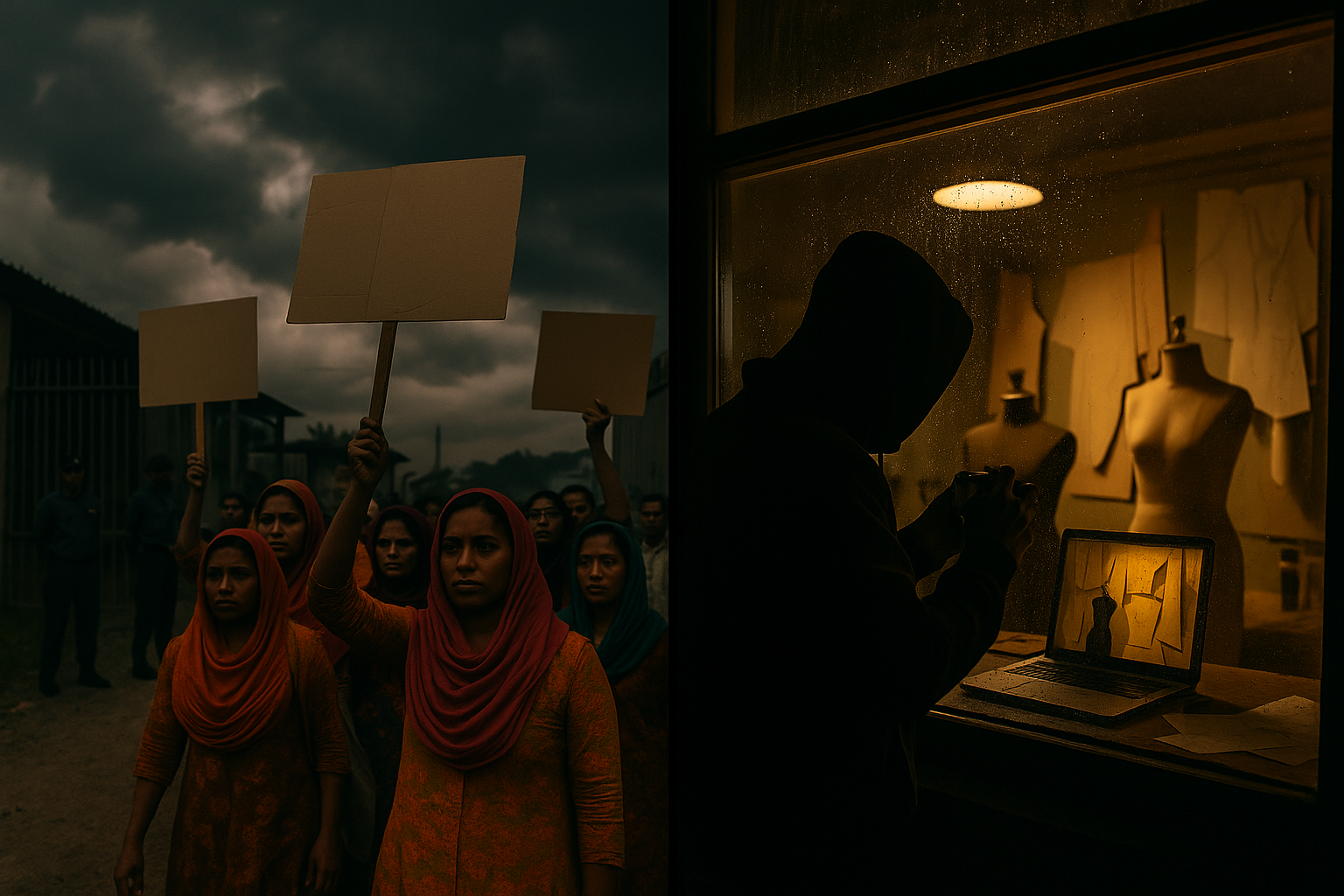

Fast-fashion giants like Zara, H&M and Shein scale by moving at extreme speed: short design-to-retail cycles, wide

assortments and global supply networks. But that speed attracts scrutiny around overproduction, waste and labour conditions.

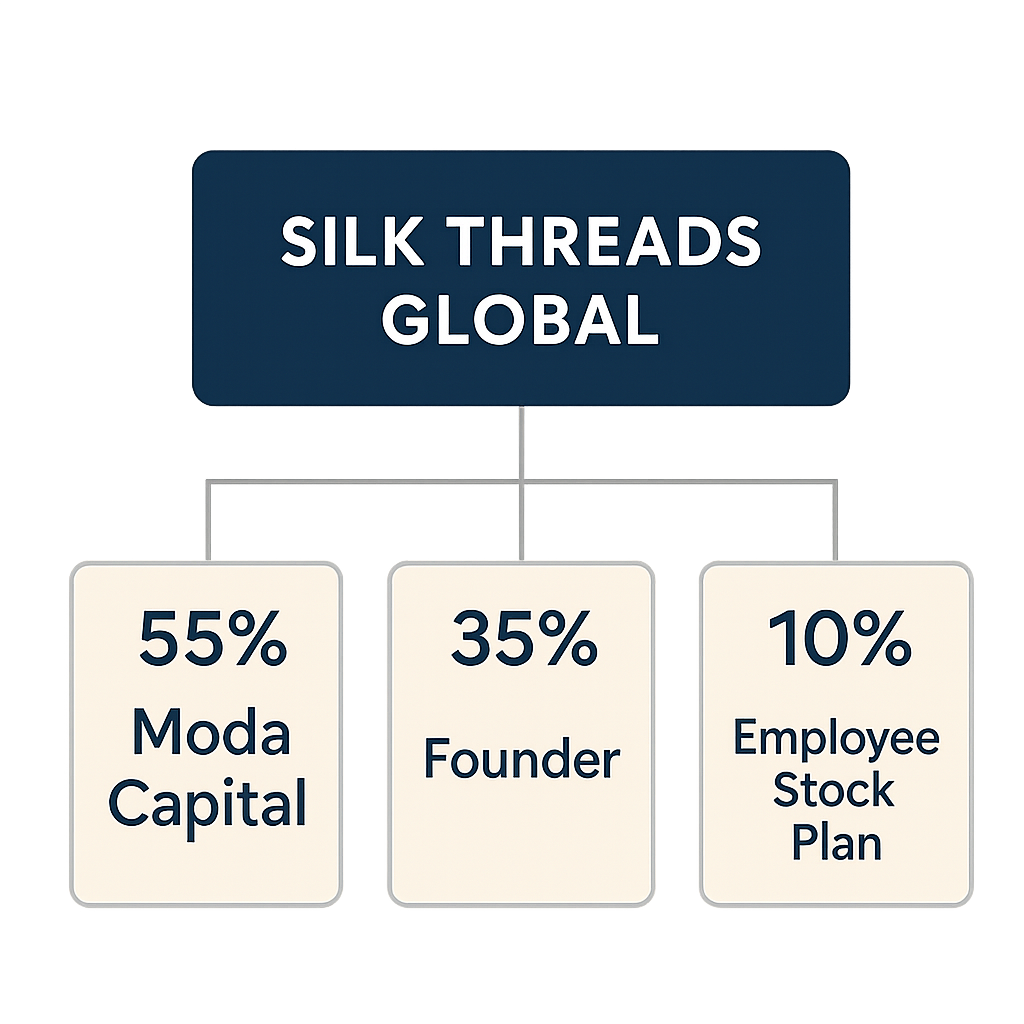

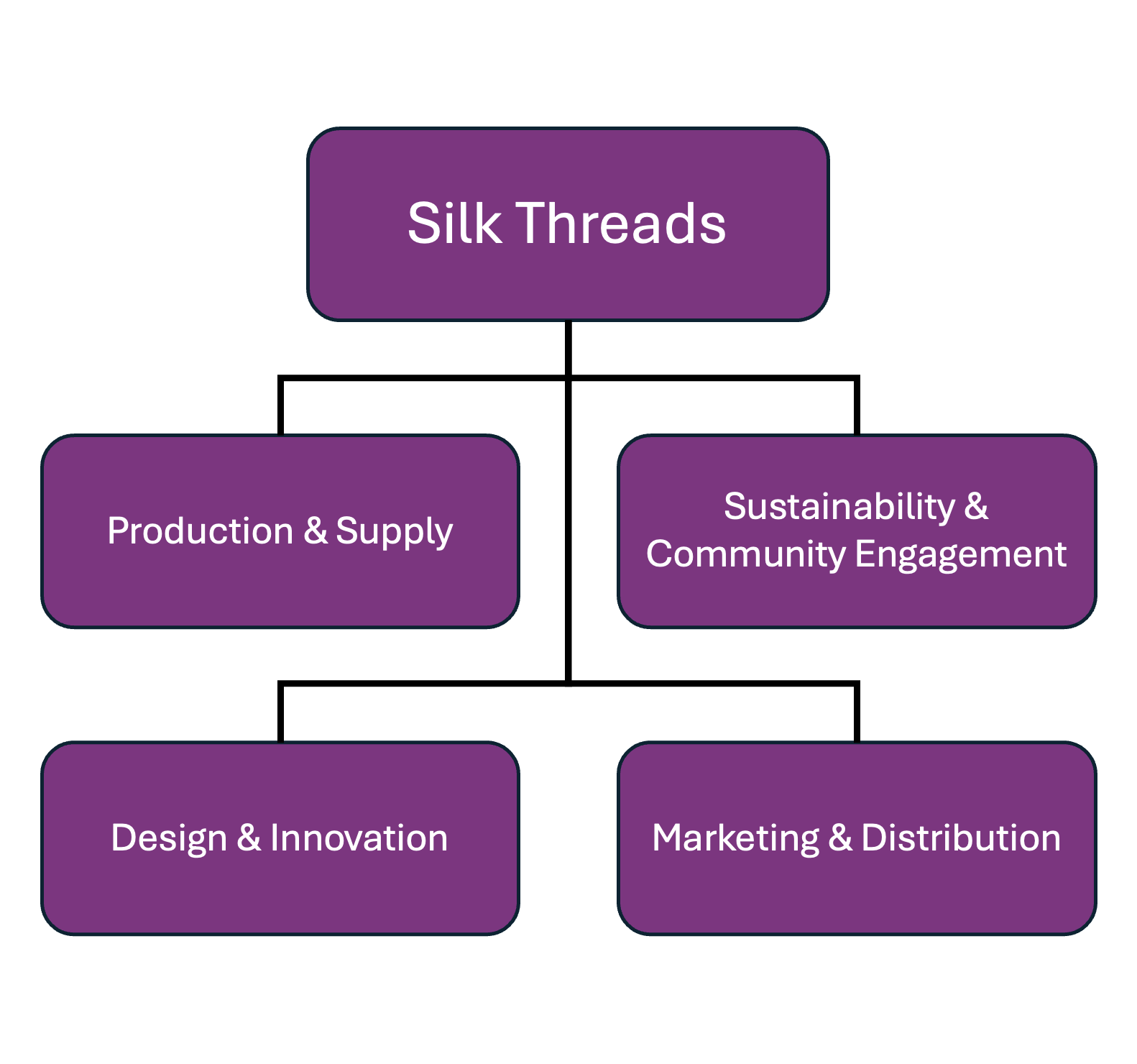

STG sits deliberately between luxury and premium. It wants the design depth and craftsmanship story of European luxury, while

still being able to talk credibly about fair wages, safe factories and lower-impact materials. The EcoLux line is the

differentiator: a way to show that luxury can be ethical without losing its edge.